In a rapidly evolving global economic landscape, the BRICS nations – Brazil, Russia, India, China, and South Africa – along with the addition of new members, are making significant strides towards de-dollarisation. This concerted effort aims to reduce their reliance on the U.S. dollar in international trade and financial transactions.

BRICS is an acronym that represents a group of five major emerging economies: Brazil, Russia, India, China, and South Africa. These countries form an association that aims to promote cooperation and collaboration on various economic, political, and strategic issues. The term “BRICS” was originally coined as “BRIC” by economist Jim O’Neill in 2001 to refer to Brazil, Russia, India, and China, four nations that were seen as rapidly growing and influential in the global economy.

South Africa joined the group in 2010, leading to the adoption of the acronym “BRICS.” The inclusion of South Africa expanded the group’s geographical representation to include an African nation. Since then, BRICS has become a platform for these countries to engage in discussions, coordinate policies, and address common challenges on both regional and global scales.

BRICS countries are characterised by their significant populations, large landmasses, and substantial contributions to global economic growth. They use the forum to discuss a wide range of topics, including economic development, trade, finance, security, and international governance. BRICS meetings and summits provide an opportunity for these nations to strengthen their ties and collaborate on matters of mutual interest while also addressing global issues like climate change, terrorism, and economic stability.

One of the central ideas in this de-dollarisation push is the creation of a new currency, often referred to as “the bric.” This currency is envisioned as a formidable contender to challenge the dollar’s dominance in cross-border trade. The motivation behind this initiative is clear: to provide an alternative means for BRICS nations to conduct trade, reducing their dependence on the dollar’s stability and fluctuations.

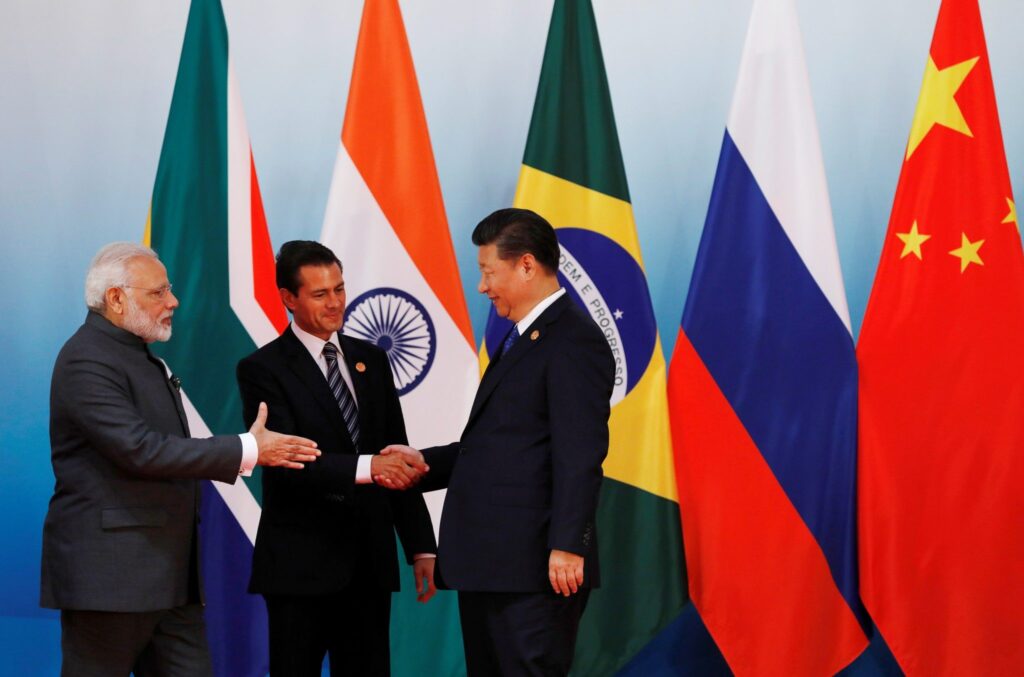

However, the path to de-dollarisation is laden with complexities and challenges. Trust issues among BRICS nations and differing priorities have raised questions about the practicality of creating a common BRICS currency. Economists like Jim O’Neill have even dubbed this idea “ridiculous.” They point to fundamental disagreements between China and India, which have historically admired each other but have seen their relationship deteriorate due to recent conflicts and tensions. This strained relationship poses a significant obstacle to realising a common currency within BRICS.

Moreover, Leslie Maasdorp, an official from the New Development Bank, suggests that common currency ambitions remain a “medium- to long-term ambition.” South Africa’s finance minister opposes it, citing the need for a central bank and the potential loss of monetary policy independence. Economists Jim O’Neill and Neil Shearing highlight challenges, particularly India-China relations, making a common currency unlikely.

China, being a pivotal member of BRICS, has been proactive in its efforts to elevate the role of the renminbi (RMB) in global trade within the group. Despite these efforts, the U.S. dollar continues to dominate a substantial portion of global foreign exchange transactions and reserves. Geopolitical complexities further compound the challenge, making it unlikely that the dollar’s supremacy will be easily usurped.

To reduce reliance on the U.S. dollar, the BRICS New Development Bank (NDB) has adopted a new strategy. It involves shifting towards lending more in the local currencies of member nations, such as the South African rand, Brazilian real, and Indian rupee. This approach aligns with the broader de-dollarisation goals of the BRICS nations and represents a practical step towards diversifying their financial transactions.

At a recent BRICS summit, discussions on de-dollarisation were prominent, but divisions among leaders were evident. SWIFT data from July showed a record 46% usage of the USD for foreign exchange payments. While some leaders expressed interest in alternatives, including Brazil’s President advocating for a common BRICS currency, challenges and differing opinions within the bloc persist. Russia’s President Putin emphasised de-dollarisation as “irreversible,” India recognised the difficulty of overturning longstanding payment arrangements, China focused on reforming the global financial system, and South Africa’s finance minister dismissed the notion of a BRICS currency. Economist Jim O’Neill criticised the concept, calling it “ridiculous” and citing political differences between China and India as a significant obstacle to de-dollarisation.

The China BRICS push to de-dollarise is a multifaceted process with far-reaching implications. While the creation of a common BRICS currency and complete de-dollarisation pose significant challenges, these efforts signal a shift in the global economic landscape. BRICS nations are actively seeking alternatives to the dollar’s dominance in international trade and finance.

Whether they can successfully challenge the greenback’s reign remains to be seen, but their determination and collaboration have the potential to reshape the dynamics of the international monetary system in the years to come. As geopolitical and economic landscapes continue to evolve, the BRICS nations are forging a path towards a more diversified and balanced global financial order, where the dollar’s dominance is no longer taken for granted. This process may take time, but the winds of change are blowing, and the greenback’s unchallenged reign may face its most significant test yet.

- https://foreignpolicy.com/2023/04/24/brics-currency-end-dollar-dominance-united-states-russia-china/

- https://fortune.com/2023/08/24/brics-new-6-nations-threat-dollar-de-dollarization/

- https://markets.businessinsider.com/news/currencies/dedollarization-china-india-russia-leaders-brics-summit-yuan-rupee-2023-8

- https://fortune.com/2023/08/15/when-will-dollar-be-replaced-brics-currency-ridiculous-china-india/

- https://markets.businessinsider.com/news/bonds/china-brics-bank-dedollarization-dollar-dominance-debt-local-currency-lending-2023-8