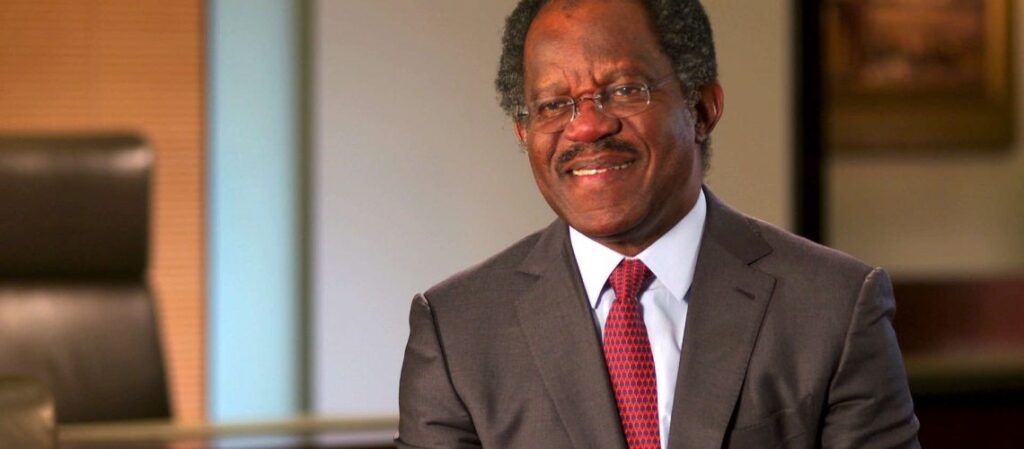

Adebayo Ogunlesi is a name synonymous with financial acumen, infrastructure development, and global leadership. Born in Nigeria on December 20, 1953, Ogunlesi has risen to international prominence as a visionary investor, attorney, and businessman. His remarkable journey from humble beginnings to overseeing some of the world’s largest infrastructure deals demonstrates his remarkable skill and his unwavering dedication to progress.

Adebayo Ogunlesi’s academic journey began at King’s College, Lagos, Nigeria. Afterwards, he received a scholarship to attend Oxford University, where he earned an M.A. in Philosophy, Politics, and Economics (PPE). His dedication to education and excellence continued as he attended Harvard Law School, earning a Juris Doctor (JD) degree.

Upon completing his education, Ogunlesi joined the prestigious law firm Cravath, Swaine & Moore in 1979. His tenure at the firm allowed him to develop a strong foundation in corporate law and finance, setting the stage for his future success in business.

In 1983, Adebayo Ogunlesi made a significant career move when he joined the investment banking division of Credit Suisse First Boston (CSFB). His tenure at the bank was marked by excellence, as he worked on various mergers and acquisitions, including the acquisition of The Quaker Oats Company by PepsiCo and the privatisation of the British Airports Authority (BAA).

Ogunlesi’s role in the privatisation of BAA served as a stepping stone to his future endeavours in infrastructure. He recognised the immense potential of investing in and improving airport infrastructure, which became a key theme in his career.

Adebayo Ogunlesi’s most noteworthy achievement came in 2006 when he co-founded Global Infrastructure Partners (GIP), a leading global infrastructure investment firm. GIP specialises in infrastructure investment, and under Ogunlesi’s leadership, the firm has become a major player in the industry. GIP’s diverse portfolio includes investments in airports, ports, energy, and transportation infrastructure around the world.

One of GIP’s most iconic deals was the acquisition of London Gatwick Airport, which solidified Ogunlesi’s reputation as a pioneer in infrastructure investment. The firm has since expanded its reach to include investments in the United States, Europe, Asia, and other regions, making it a global leader in infrastructure development.

Adebayo Ogunlesi is widely respected not only for his business acumen but also for his leadership style. He is known for his ability to bring together diverse teams and stakeholders to achieve common goals. His strategic vision and dedication to quality and excellence have been instrumental in GIP’s success.

Ogunlesi’s contributions to infrastructure development extend beyond his work with GIP. He has served on the boards of various organisations, including the Council on Foreign Relations, where his insights into global economics and infrastructure development have been invaluable.

Adebayo Ogunlesi’s acquisition of London Gatwick Airport is considered one of the defining moments of his career and a significant milestone in the history of infrastructure investment. This transformative deal demonstrated his vision, financial prowess, and willingness to take calculated risks in the infrastructure sector.

The acquisition of London Gatwick Airport took place in 2009, and it was made through Global Infrastructure Partners (GIP), the investment firm co-founded by Ogunlesi. GIP saw an opportunity in the privatisation of British airports, and Gatwick Airport, the second largest and busiest airport in the London area, was a prime candidate for their investment.

Here are some key details and aspects of this remarkable transaction:

1. Competition and Bidding: The acquisition of Gatwick Airport was a highly competitive process. Numerous global infrastructure investment firms and consortiums expressed interest in acquiring the airport. GIP, under Ogunlesi’s leadership, outbid other contenders by offering a winning bid of approximately £1.5 billion.

2. Privatisation: Prior to the acquisition, Gatwick Airport was owned and operated by BAA, which was controlled by Ferrovial, a Spanish infrastructure group. The acquisition marked a turning point in the privatisation of British airports, as it represented the first major London airport to be sold to private investors.

3. Modernisation and Improvement: One of the key factors behind GIP’s successful bid was their commitment to investing in the airport’s infrastructure and operations. Ogunlesi and GIP recognized the potential for Gatwick to be transformed into a more efficient and passenger-friendly airport. They pledged to invest in various upgrades, including the expansion of terminals, improvements in baggage handling, and enhancements in passenger amenities.

4. Economic Impact: The acquisition of Gatwick Airport not only had significant implications for GIP but also had broader economic implications. It created jobs, stimulated local and regional economies, and contributed to the development of London’s transportation infrastructure.

5. Long-Term Strategy: Adebayo Ogunlesi and GIP are known for their long-term investment approach. They did not view Gatwick Airport as a short-term investment but rather as part of a broader portfolio of infrastructure assets. This strategic thinking is in line with their commitment to improving and enhancing the long-term viability and profitability of their investments.

The acquisition of London Gatwick Airport is a prime example of Adebayo Ogunlesi’s ability to spot investment opportunities in the infrastructure sector and execute them successfully. Under his guidance, GIP not only acquired an iconic airport but also turned it into a thriving and efficient transportation hub. This investment underscores Ogunlesi’s dedication to global infrastructure development and his capacity to create lasting value through sound business strategy and responsible investment.

Adebayo Ogunlesi’s ownership and business interests extend beyond his involvement with Global Infrastructure Partners (GIP). While GIP remains a significant part of his portfolio, he also serves on the boards of various organisations and has had ties to other companies. Here are some notable aspects of his ownership and affiliations:

GIP (Global Infrastructure Partners): Ogunlesi co-founded and remains actively involved with GIP, one of the leading infrastructure investment firms in the world. GIP’s portfolio includes investments in various infrastructure sectors such as airports, ports, energy, and transportation on a global scale.

Aeroports de Paris (ADP): Adebayo Ogunlesi’s GIP was part of a consortium that acquired a 49.9% stake in Aeroports de Paris (ADP), the French airport operator, in 2018. This further expanded GIP’s presence in the global airport infrastructure sector.

Gas Natural Fenosa Renovables: GIP and the Abu Dhabi Investment Authority (ADIA) jointly acquired a significant stake in Gas Natural Fenosa Renovables, a subsidiary of Naturgy Energy Group, in 2020. This investment demonstrates GIP’s commitment to the renewable energy sector.

Board Positions: Beyond his ownership in various infrastructure assets, Adebayo Ogunlesi has held positions on the boards of notable organisations such as the Council on Foreign Relations and the University of Oxford Investment Committee. These positions reflect his engagement in both global economic affairs and education.

It’s important to note that Ogunlesi’s business endeavours have primarily centred around infrastructure and finance, with a particular emphasis on improving and developing the assets he and GIP acquire. His strategic leadership and commitment to long-term investment have been consistent themes throughout his career.

Adebayo Ogunlesi’s journey from a young student in Nigeria to a global leader in finance and infrastructure is an inspiring testament to the power of determination, education, and visionary leadership. His work with Global Infrastructure Partners and his contributions to the infrastructure industry have left an indelible mark on the world. Adebayo Ogunlesi’s story serves as a beacon of hope and a reminder that with hard work, dedication, and a clear vision, individuals can achieve greatness and positively impact the world on a global scale.

Sources

- https://en.wikipedia.org/wiki/Global_Infrastructure_Partners

- https://panafricanvisions.com/2014/07/adebayo-ogunlesi-owner-gatwick-airport/

- https://www.thecable.ng/extra-fg-describes-bayo-ogunlesi-as-owner-of-gatwick-airport-in-national-honours-list

- https://www.reportersatlarge.com/2023/04/02/adebayo-ogunlesi-the-nigerian-man-who-bought-londons-second-biggest-international-airport/

- https://en.wikipedia.org/wiki/Adebayo_Ogunlesi#:~:text=He%20currently%20serves%20as%20Chairman,deal%20worth%20%C2%A31.455%20billion.

- https://autojosh.com/adebayo-ogunlesi/