Economics and politics are two inextricably intertwined fields shaping societies and global trends. Each decision in the political arena can ripple out, causing significant economic changes, and vice versa. The interplay between these two spheres forms the bedrock of world order and development, impacting everything from international relations to individual livelihoods. Several scholars such as Thomas Piketty in “Capital in the Twenty-First Century” and Dani Rodrik in “Straight Talk on Trade: Ideas for a Sane World Economy” have delved into this relationship, illuminating its complexity and criticality. This article aims to unpack the dynamic interface between politics and economics and its far-reaching consequences on global trends.

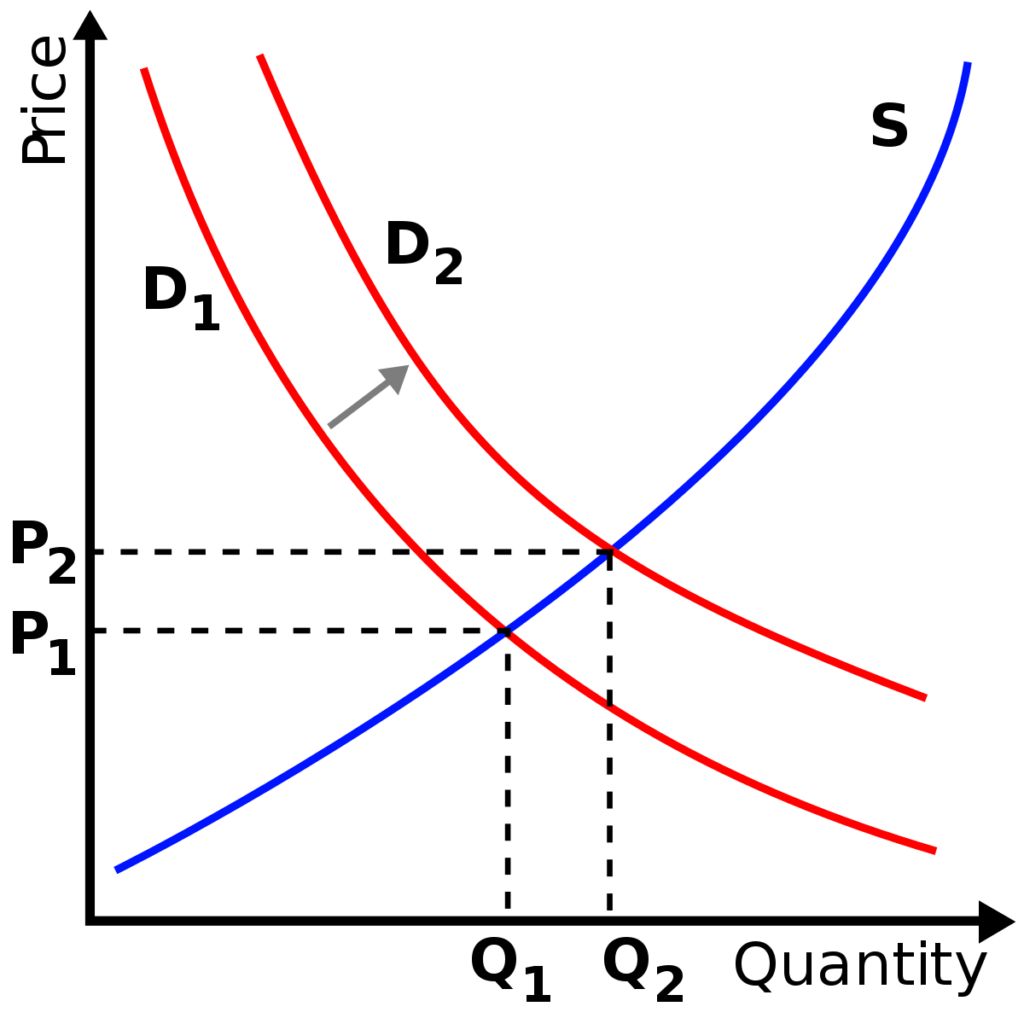

When examining the influence of politics on economic situations, it’s clear that political actions and decisions can directly shape economies. A stark illustration of this connection comes from policy decisions, where political agendas can mould economic landscapes. Trade policies, for instance, can either foster or hinder economic relationships between countries. Favourable trade policies can stimulate economic growth by opening markets and eliminating barriers to goods and services. On the contrary, protectionist trade policies, like tariffs and quotas, may foster domestic industries but can also lead to trade wars and economic slowdowns.

Another arena where politics directly impacts economics is fiscal policy. Governments can influence their economies through changes in tax rates and public spending. For instance, lowering taxes can spur economic growth by leaving consumers with more disposable income. Conversely, excessive public spending without fiscal prudence can lead to inflation or even a debt crisis.

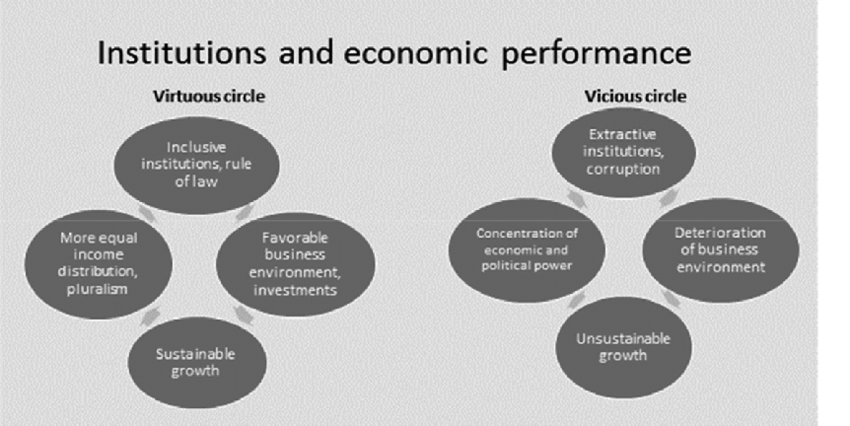

Additionally, political instability can also significantly impact an economy. Countries rife with conflict and political instability often face economic downturns due to factors like reduced foreign investment and disruptions in the production and distribution of goods. For instance, the prolonged political unrest in Venezuela has led to severe economic crises, including hyperinflation and shortages of basic goods.

Moreover, geopolitics plays a crucial role in determining the economic fate of nations. The economic sanctions placed on countries for political reasons can cripple their economies, as witnessed in countries like Iran and North Korea.

Hence, it is clear that political actions, from policy decisions to geopolitical moves, can significantly impact economies. This understanding becomes even more critical when we consider the global trends that emerge from this interplay.

In the same vein, economic situations can exert substantial influence on political landscapes. For example, the global financial crisis of 2008 led to widespread public dissatisfaction and mistrust of governments, leading to political changes in many countries. In Iceland, the government fell due to mass protests over economic mismanagement, while in the United States, the crisis and subsequent recession played a pivotal role in Barack Obama’s election.

Further, economic inequality can also shape political discourse and policies. Increased economic disparities often lead to political unrest and push for reforms. In the past decade, movements such as Occupy Wall Street in the United States and the Yellow Vest movement in France were primarily fuelled by economic grievances, demonstrating how economic situations can drive political activism and policy change.

Moreover, strong economic performance can legitimise political leadership, while economic downturns can destabilise governments. A robust economy often bolsters public confidence in their leaders and lends credibility to their governance. Conversely, economic recessions or crises can erode public trust in leadership, potentially leading to shifts in political power. This dynamic is not limited to democratic societies; authoritarian regimes, too, can be destabilised by poor economic performance.

Lastly, the state of the economy can significantly impact foreign policy. Countries experiencing economic prosperity are more likely to engage in international affairs, aid programs, and peacekeeping missions. In contrast, nations facing economic crises tend to focus more on internal issues, limiting their international engagements.

In conclusion, the economic landscape of a country or region can significantly shape its political dynamics, influencing everything from policy direction to the stability of governance.

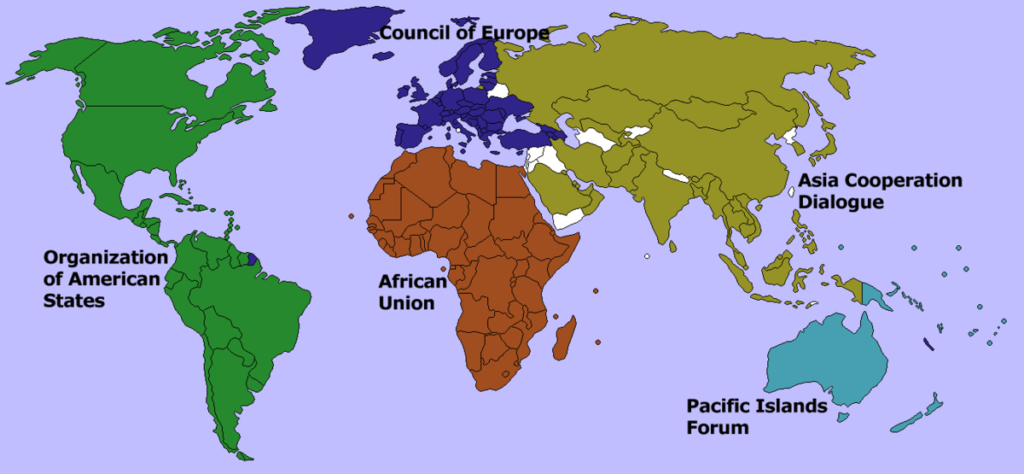

The relationship between economics and politics shapes global trends, influencing the direction of societies and nations worldwide. It is this intricate interplay that constructs the world order, dictating power dynamics on a global scale.

The rise of China as a global superpower is a poignant example of this relationship. China’s economic growth, fuelled by state-led industrial policies and open market reforms, has substantially increased its political clout on the international stage. It has utilised its newfound economic might to shape global institutions, advance its Belt and Road Initiative, and assert its territorial claims in the South China Sea.

Similarly, the EU’s economic integration, underpinned by the euro and the single market, has not only created a powerful economic bloc but also a potent political force. Despite facing several challenges, like the Greek debt crisis and Brexit, the EU continues to exercise significant influence over global economic and political matters.

Conversely, the decline of economies can also redraw global political maps. The fall of the Soviet Union, precipitated by economic stagnation and systemic inefficiencies, led to a significant shift in global power dynamics, marking the end of the Cold War era.

Moreover, economic development trends such as digitisation and automation have political implications. These trends challenge traditional norms around work, welfare, and governance, triggering debates about income inequality, job security, and digital privacy.

In essence, the entwined nature of economics and politics shapes the broader narrative of global trends. Understanding this relationship is fundamental to anticipate future trajectories and develop sustainable, equitable policies at both national and international levels.

Conclusion

The profound and complex interaction between economics and politics is central to understanding the evolution of global trends. As demonstrated, political actions can mould economic landscapes, influencing trade, fiscal policies, and economic stability. Conversely, economic circumstances can shape political landscapes, driving political change, impacting leadership credibility, and steering foreign policies. It is within this mutual interplay that global trends and power dynamics emerge.

Significant phenomena, such as China’s ascendance, the EU’s integration, the digitisation and automation of economies, and the fall of the Soviet Union, underscore the real-world implications of this relationship. Each of these instances underscores the potential for economic factors to drive political change and for political actions to have economic consequences.

Thus, our understanding of these interactions is critical for forming robust, effective policies and strategies at both national and international levels. Future leaders, policymakers, and citizens must acknowledge and engage with this dynamic interplay to navigate the complexities of the global economic-political landscape successfully.

As we look to the future, the role of economics in politics, and vice versa, will continue to shape the world. As such, continued analysis and understanding of this relationship are imperative for informed decision-making.

Sources

- Piketty, T. (2014). Capital in the Twenty-First Century. Belknap Press.

- Rodrik, D. (2017). Straight Talk on Trade: Ideas for a Sane World Economy. Princeton University Press.

- Fergusson, L. (2016). The World Trade Organization and Trade in Services. Routledge.

- Chinn, M. D., & Ito, H. (2006). What matters for financial development? Capital controls, institutions, and interactions. Journal of Development Economics, 81(1), 163-192.

- Sachs, J. D., & Warner, A. (2001). The curse of natural resources. European Economic Review, 45(4-6), 827-838.

- Hufbauer, G. C., Schott, J. J., & Elliott, K. A. (2009). Economic sanctions reconsidered. Peterson Institute for International Economics.

- Blanchard, O., Dell’Ariccia, G., & Mauro, P. (2010). Rethinking macroeconomic policy. Journal of Money, Credit and Banking, 42(s1), 199-215.

- Piketty, T. (2014). Capital in the Twenty-First Century. Belknap Press.

- Bates, R. H. (2008). When things fell apart: state failure in late-century Africa. Cambridge University Press.

- Dreher, A., Nunnenkamp, P., & Thiele, R. (2008). Does US aid buy UN general assembly votes? A disaggregated analysis. Public Choice, 136(1-2), 139-164.

- Naughton, B. (2007). The Chinese Economy: Transitions and Growth. MIT press.

- Moravcsik, A. (2013). The European Union – An Emerging Global Actor? In EU External Relations Law (2nd ed., pp. 246-278). Oxford University Press.

- Kotz, D. M. (2009). The Financial and Economic Crisis of 2008: A Systemic Crisis of Neoliberal Capitalism. Review of Radical Political Economics, 41(3), 305-317.

- Brynjolfsson, E., & McAfee, A. (2014). The Second Machine Age: Work, Progress, and Prosperity in a Time of Brilliant Technologies. W. W. Norton & Company.

- Rodrik, D. (2017). Straight Talk on Trade: Ideas for a Sane World Economy. Princeton University Press.

- Sachs, J. D. (2015). The Age of Sustainable Development. Columbia University Press.

- Stiglitz, J. E. (2002). Globalization and its Discontents. W. W. Norton & Company.