Introduction

Off-balance-sheet (OBS) activities are business assets and liabilities that do not appear on the balance sheet. Typically, these activities involve risk sharing or off-balance-sheet financing. These transactions were widely utilised by banks in the United States prior to the year 2000, but their usage decreased following the 2008 financial crisis. Over the past four decades, there has been a significant increase in OBS activities by financial activities, and in the business structure of modern commercial banks, OBS activities are gaining importance and prominence. This report discusses the factors that explain the growth of OBS activities in the US banking industry prior to 2000 and their decline since 2010.

What are off-balance-sheet activities, exactly? The OBS activities are illustrated by the following examples: 1. operating leases The use of letters of credit 3. Credit default swap 4. Joint ventures 5. Special purpose entities (SPEs). OBS activities are essential for investors to evaluate the financial situation and health of a company, and one of their characteristics is that they are highly leveraged and risky. The derivatives market is the most representative and leveraged market. Prior to the subprime mortgage crisis, OBS activities constituted a significant source of profit for Western commercial banks. Banks will package and sell mortgage-backed securities (MBS) and collateralized debt obligations (CDO) to investment banks, investment funds, commercial banks, etc., which will then split, package, and sell asset-backed securities (ABS) once more. In order to generate enormous profits, they typically employ 20 to 30 times leverage, which carries a high risk.

Prior to the year 2000, there was a substantial increase in OBS activities in the United States, which the factors listed below explain.

Regulatory arbitrage

The United States banking industry is highly regulated, and banks must adhere to various capital requirements and lending restrictions. OBS activities allowed banks to circumvent these regulations and engage in activities prohibited by regulators. Banks could use OBS activities to establish off-balance-sheet entities, such as special purpose vehicles (SPVs), to hold assets and liabilities that were exempt from regulatory oversight.

Profitability

OBS activities were also appealing to banks because they could generate substantial profits without requiring the banks to hold a substantial amount of capital. Securitization and derivatives trading enabled banks to earn fees and commissions while transferring risk to investors. These activities generated substantial profits for banks, and a number of banks increased their utilisation of OBS activities to increase their earnings.

Competition

The US banking industry is extremely competitive, and banks are constantly searching for ways to gain a competitive advantage. OBS activities allowed banks to expand their operations without making significant capital or infrastructure investments. Banks could engage in asset securitization, allowing them to originate loans and then sell them to investors. Thus, banks were able to expand their lending without increasing their balance sheets.

Explanations for the decline in OBS activities since 2010

Regulation

The 2008 financial crisis revealed the risks associated with OBS activities, prompting regulators to impose stricter regulations on banks. The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 enacted several restrictions on banks’ use of OBS activities. The Volcker Rule, for instance, prohibited banks from engaging in proprietary trading and restricted their investments in hedge funds and private equity.

Risk management

Additionally, the financial crisis highlighted the significance of effective risk management in the banking industry. Numerous banks reduced their use of OBS activities as a result of banks’ increased reluctance to engage in activities that could expose them to significant risks. To ensure that they were adequately prepared for future shocks to the financial system, banks increased their emphasis on stress testing and other risk management procedures.

Economic conditions

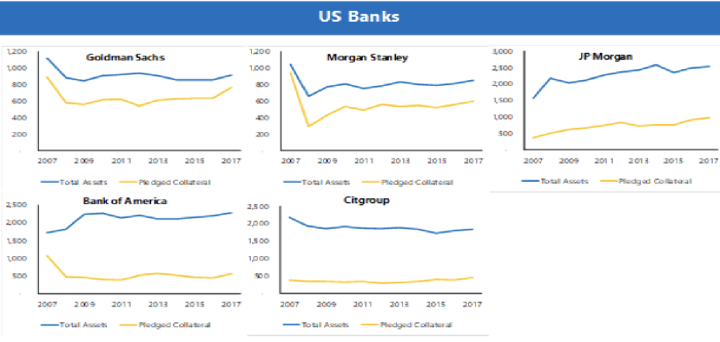

Since 2010, market conditions have also contributed to the decline in OBS activities. The financial crisis caused a significant decline in the demand for securitized assets, which had been a significant driver of OBS activities. In addition, the post-crisis environment of low interest rates made it more difficult for banks to generate profits through OBS activities. However, off-balance sheet items such as pledged collateral transactions (illustrated by the orange line below) are comparable between US and European banks. In the post-regulatory era, large global banks are focused on reducing overall costs, which includes funding costs; funding via pledged collateral on a secured basis is frequently the first option because it is less expensive than other forms of funding.

Beginning in 2001, interest rates were consistently lowered in the United States in an effort to stimulate the economy, and the US housing market was thriving, with some borrowers who could not afford to repay obtaining home loans. The excessive expansion of easy subprime lending has produced a substantial subprime derivative. As interest rates were unable to increase, home prices began to decline. Increasing loan defaults have also precipitated a bad debt crisis among sub-market lending institutions. Some institutions that purchased subprime credit derivatives were severely impacted as well. The banking industry was rife with insolvency. The subprime mortgage crisis subsequently intensified into a financial crisis. In order to avoid repeating the same errors, the United States began to regulate the subprime industry to reduce risk. US banks’ off-balance sheet activities are not as extensive as they once were. Recent research has uncovered additional evidence of economies of scale in the banking sector. For instance, McAllister and McManus (1993) and Wheelock and Wilson (2001) discover that banks must generate incremental returns to increase their total assets to at least $500 million. Both studies employ nonparametric and semi-nonparametric techniques that circumvent the issue of specifying the functional cost relationship to be estimated in advance. Similarly, studies that include banks’ risk appetite and financial capital in their production models find more evidence of incremental returns to scale than studies that disregard these effects. Hughes et al. (2001), for instance, estimate returns to scale within the context of a value maximisation model that explicitly accounts for the capital structure and risk preferences of individual banks. Hughes et al. find, based on a sample of 441 leading bank holding companies (BHCs) in 1994, that large banks are subject to significant economies of scale that increase with bank size.

Conclusion

Before the year 2000, banks in the United States made extensive use of off-balance-sheet activities, but their use declined after the 2008 financial crisis. Regulatory arbitrage, profitability, and competition all contributed to the expansion of OBS activities prior to the year 2000. In addition to regulation and risk management, market conditions also contributed to the decline in OBS activities since 2010. While OBS activities remain a part of the US banking industry, their use has diminished, and banks are now subject to more stringent regulatory oversight and risk management practises.

Sources

- Ziadeh, N. (2012, June). Bank risk exposure, bank failure and off-balance sheet activities: An empirical analysis for US commercial banks. In Paris December 2012 Finance Meeting EUROFIDAI-AFFI Paper.

- Bank business model shift softens impact of stimulus withdrawal https://www.ft.com/content/8e3f524e-7f98-3573-92a3-ed32584ac1f8

- Do Large Banks Have Lower Costs? New Estimates of Returns to Scale for U.S. Banks DAVID C. WHEELOCK, PAUL W. WILSON