Introduction

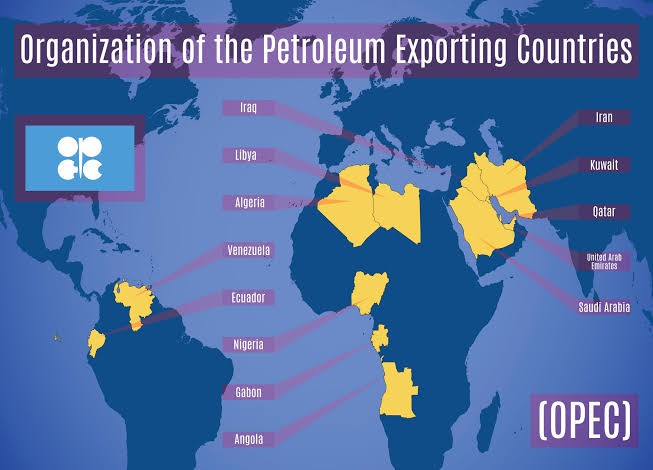

The recent decision by the Organisation of the Petroleum Exporting Countries (OPEC) to cut production targets has significant implications for the global economy. As a major player in the oil market, OPEC’s actions can impact oil prices, energy markets, and economies worldwide. This article provides a comprehensive overview of the OPEC production cut and its wider economic and political implications, particularly for the United States, the United Kingdom, and Nigeria.

Overview of the OPEC Production Cut

The Organisation of the Petroleum Exporting Countries (OPEC) has sent shockwaves through the global economic and political landscapes with its recent decision to reduce oil production quotas by 20%, a significant decrease projected to impact the worldwide oil supply until the end of 2024. This monumental decision is a result of multiple intertwined factors, encompassing fluctuating market dynamics and multifaceted geopolitical considerations.

Economic Implications

At the heart of this issue is a fundamental economic principle: supply and demand. With a reduced oil supply and robust, consistent demand, prices inevitably rise. Early indicators confirm this, as oil prices have seen an immediate surge in the wake of OPEC’s announcement.

Countries such as the United States and the United Kingdom, which are primarily oil importers, will face the brunt of this cost surge. For instance, rising fuel prices often lead to higher transport costs, which subsequently influence the prices of goods and services, resulting in increased inflation. The US has already proactively adjusted its gas price forecast in light of OPEC’s decision, anticipating a surge in domestic energy costs.

In the United Kingdom, a similar trend is expected. Elevated oil prices could translate into higher operating costs for businesses, particularly those reliant on transportation or energy-intensive processes. For households, the surge in energy costs could mean higher heating bills and increased expenses for private transportation. The knock-on effects of these cost increases may contribute to overall inflationary pressures in the UK economy, impacting living standards and possibly prompting policy changes by the Bank of England.

Implications for the United States

The OPEC production cut has both positive and negative implications for the United States. On one hand, higher oil prices resulting from the production cut can benefit the U.S. shale industry. As oil prices rise, shale producers may find it economically viable to increase production, bolstering domestic energy production and employment. However, increased energy costs can also impact various sectors of the U.S. economy, including transportation, manufacturing, and consumer spending, potentially dampening economic growth.

Moreover, the OPEC production cut could impact U.S. energy independence goals. The United States has made significant strides in recent years to reduce its reliance on imported oil, primarily due to the shale revolution. However, higher oil prices resulting from the OPEC production cut may lead to increased oil imports, challenging the country’s energy security and economic stability.

Political Ramifications

The economic consequences of OPEC’s decision will have inevitable political ramifications. Relationships between OPEC nations, led informally by Saudi Arabia, and oil-importing nations may experience tension. As the US and the UK grapple with domestic economic pressures, they may seek to exert diplomatic influence on OPEC to reverse or mitigate the impact of the decision. This scenario could lead to an escalation in geopolitical tensions, prompting a complex juggling act of international relations and domestic economic priorities for these nations.

Impact on Oil-Exporting Countries

The story is different for oil-exporting nations such as Nigeria, a prominent OPEC member. The decision to cut production was, as per multiple sources, agreed upon by Nigeria and other OPEC members. From an economic perspective, the short-term impact on Nigeria could be beneficial. With the rise in oil prices, revenues from oil exports could see a substantial increase, offering a boost to the national economy.

However, this immediate financial gain should be considered in tandem with longer-term risks. Over-reliance on oil revenue can make Nigeria’s economy vulnerable to oil market fluctuations and shifts in global energy consumption patterns. As the world is gradually moving towards renewable energy sources, a significant reliance on oil revenue could prove detrimental for countries like Nigeria in the long run.

Implications for the United Kingdom

The OPEC production cut also has implications for the United Kingdom, although its impact may be somewhat different from that on the United States. As an oil-importing nation, the UK could face challenges from higher energy costs, potentially affecting consumer spending and business investment. Industries that are heavily dependent on oil, such as transportation and manufacturing, may experience increased operational costs.

On the other hand, the UK’s North Sea oil industry, although relatively smaller compared to global producers, could benefit from the production cut. Higher oil prices may improve the viability of North Sea operations, supporting the country’s domestic oil production and potentially contributing to increased employment and government revenue.

Implications for Nigeria

As a major oil producer and OPEC member, Nigeria is directly affected by the OPEC production cut. The decision to reduce production quotas has significant implications for Nigeria’s economy, which heavily relies on oil exports. On one hand, higher oil prices resulting from the production cut can bolster government revenue, supporting fiscal stability and potential investments in infrastructure and social programs.

However, Nigeria also faces challenges related to oil dependence. The country’s economy is vulnerable to fluctuations in oil prices, and a production cut can limit revenue generation. To mitigate the impact, Nigeria needs to diversify its economy, reduce dependency on oil, and promote other sectors such as agriculture, manufacturing, and services.

Accelerating Shift to Renewable Energy

Interestingly, OPEC’s production cut could also spur an unintended global consequence – it could expedite the shift away from fossil fuels. Countries facing higher oil prices may be compelled to accelerate their transitions towards greener energy alternatives. The heightened urgency for renewable energy sources and electric vehicles could add a new layer of complexity to the already intricate landscape of global climate politics.

Conclusion

OPEC’s decision to cut oil production targets is undeniably a watershed moment with far-reaching economic and political implications. The immediate fallout is economically significant, with oil-importing countries feeling the pinch of higher prices. The political repercussions are equally substantial, potentially reshaping relationships between OPEC members and other nations. Countries like Nigeria find themselves straddling the benefits of immediate financial gain and the risks of long-term economic exposure. However, amidst these multifaceted challenges, this development might also serve as a catalyst to accelerate the world’s transition to sustainable energy, potentially offering a glimmer of hope in a complex situation.