The Corporate Affairs Commission (CAC) has issued a strong warning to Point-of-Sale (PoS) operators nationwide as it prepares to launch a major enforcement drive against businesses operating without proper registration.

In an announcement shared on its Instagram page on Saturday, the Commission expressed worry over the rising number of PoS agents who continue to run their operations without formal registration. This concern is not new, as the CAC had previously signaled plans to clamp down on unregistered PoS businesses in 2024—a move that drew objections from many operators.

According to the latest statement, the Commission stressed that the growing presence of unregistered PoS operators directly violates provisions of the Companies and Allied Matters Act (CAMA) 2020 and the Central Bank of Nigeria’s Agent Banking Regulations. It also accused certain fintech firms of contributing to the problem by onboarding agents who have not fulfilled CAC registration requirements. The Commission described this practice as irresponsible, warning that it threatens the integrity of Nigeria’s financial system and exposes citizens—especially small business owners and people in underserved communities—to financial fraud and investment risks.

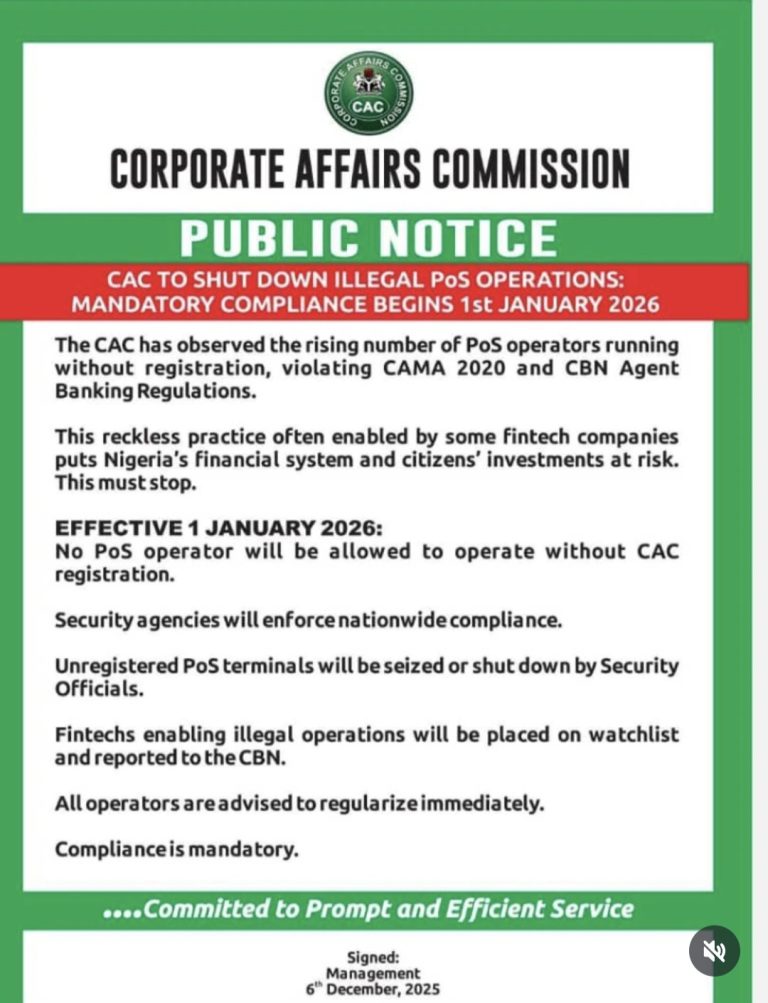

The CAC further announced that beginning 1 January 2026, all PoS operators must complete their registration with the Commission before they can legally conduct business in Nigeria. It said security agencies have been mandated to enforce compliance nationwide.

“Effective 1 January 2026, no PoS operator will be allowed to operate without CAC registration. Security agencies will enforce nationwide compliance. Unregistered terminals will be seized or shut down. Fintechs enabling these illegal activities will be flagged and reported to the CBN. All operators are advised to regularise immediately. Compliance is mandatory,” the statement read.

In a related development, The Nation recently reported concerns raised by Olufemi Bamisile, chairman of the House of Representatives ad hoc committee investigating the economic and security implications of cryptocurrency usage and PoS operations. Bamisile highlighted a troubling surge in fraud linked to PoS activities, noting issues such as unregistered agents, cloned terminals, anonymous transactions, and weak Know-Your-Customer (KYC) procedures. He warned that these lapses are placing Nigerians at growing risk of financial losses, cybercrime, and wider security threats.